Monday, March 29, 2010

Indian Technology Sector Prospects in 2010

Sunday, March 28, 2010

Indian Stock Recommendations,latest brokerage reports

GAIL (India) Ltd (Hold) Rs. 401.30 -0.40 (0.00%) Larsen & Toubro Ltd (Hold) Rs. 1635.55 -4.35 (-0.04%) NMDC Ltd (Hold) Rs. 298.30 -5.90 (-0.06%) Bajaj Auto Ltd (Hold) Rs. 1976.60 97.05 (0.97%) STOP LOSS: Rs.1933.00 TARGET: Rs. 2020.00 Suzlon Energy Ltd (Hold) Rs. 72.80 -0.20 (0.00%) STOP LOSS: Rs.70.00 Cairn India Ltd (Hold) Rs. 295.00 -3.45 (-0.03%) Dabur India Ltd (Hold) Rs. 164.90 4.80 (0.05%) STOP LOSS: Rs.146.00 ICICI Bank Ltd (Hold) Rs. 947.70 22.10 (0.22%) STOP LOSS: Rs.910.00 Unitech Ltd (Hold) Rs. 71.40 -0.60 (-0.01%)

Friday, March 19, 2010

Latest Stock Recommendations

Latest stock recommendations from the various research and brokerage firms

Reliance Industries Ltd (Hold)

Rs. 1089.80 14.75 (1.37%)

STOP LOSS: Rs.1060.00 TARGET: Rs. 1091.00

Ashu Bagri - Technical analyst at SBI Capital Securities

Technically, the stock has a strong resistance at around 1091 levels. The investor can hold the counter with a trailing-stop-loss at 1060 and exit at around 1091 levels.

Unitech Ltd (Hold)

Rs. 73.70 0.00 (0.00%)

Ashish Kapur - CEO at Invest Shoppe

The counter looks promising as the demand is picking up. Its debt is expected to go down. So the investor can hold from a long-term perspective, as the stock can pick up the momentum in coming days.

Unitech Ltd (Hold)

Rs. 73.70 0.00 (0.00%)

STOP LOSS: Rs.67.00 TARGET: Rs. 103.00

Ashu Bagri - Technical analyst at SBI Capital Securities

The counter can go up to 103 after breaking the immediate resistance of around 80 levels. The investor can hold the counter with a stop-loss at 67.

Bharti Airtel Ltd (Hold)

Rs. 311.85 11.85 (3.95%)

Ashish Kapur - CEO at Invest Shoppe

Fundamentally, the stock has good upside potential. The investor can hold and accumulate the counter from long-term perspective.

Bharti Airtel Ltd (Hold)

Rs. 311.85 11.85 (3.95%)

STOP LOSS: Rs.280.00 TARGET: Rs. 335.00

Ashu Bagri - Technical analyst at SBI Capital Securities

The counter looks upward in current trade-pattern. The investor can hold the counter with a strict stop-loss at 280 and exit at around 335 levels.

HDFC Bank Ltd (Hold)

Rs. 1818.20 15.15 (0.84%)

Ashish Kapur - CEO at Invest Shoppe

The housing sector is expected to boom in coming days and HDFC has a strong presence in housing loan segment. So its business looks secured and an investor can hold the counter from a long-term perspective.

HDFC Bank Ltd (Hold)

Rs. 1818.20 15.15 (0.84%)

STOP LOSS: Rs.2600.00 TARGET: Rs. 2685.00

Ashu Bagri - Technical analyst at SBI Capital Securities

The counter can go up to 3,292 if breaks the immediate resistance at around 2,865 levels. The investor can hold the counter with a trailing-stop-loss at 2600 for the first target at around 2865 levels.

Glenmark Pharmaceuticals Ltd (Hold)

Rs. 245.40 3.30 (1.36%)

STOP LOSS: Rs.229.00 TARGET: Rs. 272.00

Mileen Vasudeo - Technical Analyst at Angel Broking

The counter looks bullish technically. The investor can hold the counter for the target at around 272 levels with a stop-loss at 229 levels.

National Aluminium Company Ltd (Hold)

Rs. 403.25 0.60 (0.15%)

TARGET: Rs. 500.00

Vikram Bhatt - Consultant at Positive Finnovationz

Fundamentally, the stock looks positive. It has acquired new lease for its mines. The investor can hold the counter for medium-term target of 370 and long-term target of 500.

National Aluminium Company Ltd (Buy)

Rs. 403.25 0.60 (0.15%)

STOP LOSS: Rs.380.00 TARGET: Rs. 480.00

Mileen Vasudeo - Technical Analyst at Angel Broking

The stock can surge up to 480 levels after breaking the 414 resistance levels. The investor can hold the counter with a stop-loss at 380.

Indian Stock Screener Tools

There are several ways to learn about new companies and sectors to invest your hard money in. I am being a dumb investor (yes, still I am even after a couple of years in the market!!) dependent so far on business news websites like moneycontrol.com, business-standard.com. Usually, I come across an interesting story, like millions of other readers, and then start to dig a little into sector and/or companies mentioned.

But, I learnt that this top-down approach is not the most effective way since the news papers, sites, analysts and brokerage firms can and will cover only a small percentage of the companies listed on NSE/BSE and you miss out on the bigger percentage where some of the best opportunities lie hidden. And you basically just follow the crowd since everyone have the same information as you!

So, the obvious (which was not so obvious till a week ago) question was "is there a better way?."

And the answer is yes, that’s what I got while reading a book yesterday and it’s called stock screening. Stock screening, simply put, is the process of filtering/identifying companies, from thousands across sectors and industries, based on parameters that meets an individual's risk, expected returns, and even taste. One example could be searching for companies with a dividend yield of 4% or more. Of course, this will only help you cut down the number of companies to look at from 1000s to, possibly, few 10s but then one needs to analyze each company further to better understand its business, past and future(expected) performance before making a decision of whether to invest in it or not.

Since we are lucky to be living in an internet age this screening process is not as daunting as it could sound like. There are several tools, limited for Indian stocks but numerous for US listed ones, that help with this and some of the good ones are really free! The following is the list of some sites and tools that provide free tools to screen NSE and BSE listed stocks.

IDBI Paisabuilder

http://www.idbipaisabuilder.in/Market_Content/CMcorpinfo.aspx

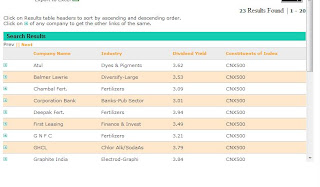

I had used this site in the past and I really like it. It provides a decent number of parameters, more than equity master which comes next in the list, to filter stocks on and the research section of the site also includes various other useful tools that can be really useful. The following screenshots shows the search form and the results for a search on stocks in NSE 500 that have a dividend yield of more than 3%

Search form:

Search results:

EquityMaster

http://www.equitymaster.com/research-it/company-info/search/internal.asp

This has a decent stock screener; the following screenshot shows the results I got for companies having a dividend yield between 3% and 4%.

There are few bugs with this tool though, the year criterion in the search form is only till 2007 but the search still does give results for 2009 and 2008 so I am not sure (have not compared against other tools) if the results are accurate and reflect latest information.It also has other useful tools like

ICICI Direct Research

http://content.icicidirect.com/research/customsearch.asp

ICICI Direct also provides a screener but the search form is limiting in the parameters e.g. I could only search large cap stocks, and not all, with dividend yield greater than 3%

BSE

http://www.bseindia.com/stockscanner/stockscanner.aspx

BSE website also find a stock screener but again the form is limited to four criteria (see screenshot below)

Buzzing Stocks

http://www.buzzingstocks.com/in/search.pl

This one is different in the sense that it lets you screen stocks based on technical parameters. The search form takes criterion in plain english and it also comes with a pre-defined list that users can use. I plan to use if I buy anything for trading purpose. The following screen shot shows list of stocks that have had serious buying interest and which could go up higher.

There could be other tools and I plan to update this post as and when I come across them.

RK.

Other posts that could be of interest:

Warren buffets low diversification good for average investors?

Think before investing in india's ETFs

Stock picks top 20 indian stocks to own

Financial bubbles of next decade

Little book that beats the market

Sunday, March 7, 2010

India Brokerage Recommendations : Stock advices for first week of march

This post covers some of the recommendations and advices of the Indian brokerage and research firms that came out in the first week of March. This is a follow up to my first post where I started tracking the recommendations from Indian brokerage and research firms.

In the last week - Aurobindo Pharma had two BUY calls, a number of IT companies also had a BUY and there was one REDUCE for Ranbaxy. The following is the list

| Date | Brokerage/Research Firm Name | Stock | Recommendation | Target | Price on the date of recommendation |

| 5-Mar-10 | Prabhudas Lilladher | Infosys | BUY | 3,250 | |

| 5-Mar-10 | Firstcall Research | NIIT | HOLD | 76 | 66.5 |

| 5-Mar-10 | Firstcall Research | Bilpower | HOLD | 205 | 177.65 |

| 5-Mar-10 | Reliance Securities | Dishman Pharma | HOLD | 238 | 208 |

| 4-Mar-10 | Firstcall Research | SREI Infra | BUY | 90 | 73.45 |

| 4-Mar-10 | Firstcall Research | Mundra Port | BUY | 790 | 709 |

| 5-Mar-10 | Karvy | Inox Leisure | MARKET PERFORMER | 79 | |

| 3-Mar-10 | Sunidhi Securities | KPIT Cummins | BUY | 140 | 112 |

| 4-Mar-10 | Angel Securities | Balrampur Chini | NEUTRAL | ||

| 3-Mar-10 | Firstcall Research | Jyoti Structures | BUY | 200 | 161 |

| 3-Mar-10 | Firstcall Research | Tata Power | HOLD | 1499 | |

| 3-Mar-10 | Emkay | South Indian Bank | BUY | 180 | |

| 3-Mar-10 | SKP Research | Aurobindo Pharma | BUY | 1800 | |

| 3-Mar-10 | Angel Securities | Ranbaxy Labs | REDUCE | 445 | |

| 3-Mar-10 | Anand Rathi | Pratibha Industries | BUY | 501 | 350 |

| 3-Mar-10 | Hem Securities | Videocon Ind | BUY | 280 | |

| 2-Mar-10 | Motilal Oswal | Financial Tech | BUY | 1822 | |

| 3-Mar-10 | Karvy | Aurobindo Pharma | BUY | 1283 | 970 |

| 26-Feb-10 | Angel Securities | Tata Motor | BUY | 942 | |

RK